child tax credit portal phone number

Making a new claim for Child Tax Credit. Specifically the Child Tax Credit was revised in the following ways for 2021.

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Preparer tax identification number or personal identification number.

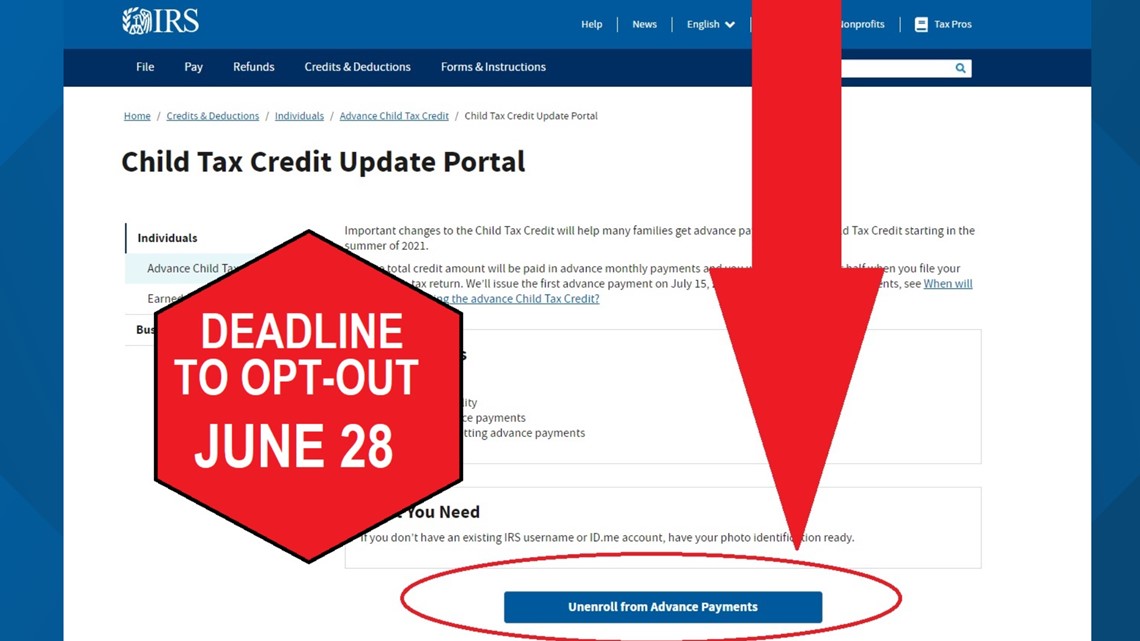

. For more tax info heres how to track your refund through the mail or to your bank account. If you dont have internet access or cant use the online tool you can unenroll by contacting the IRS at the phone number on your Advance Child Tax Credit Outreach Letter you. The credit amount was increased for 2021.

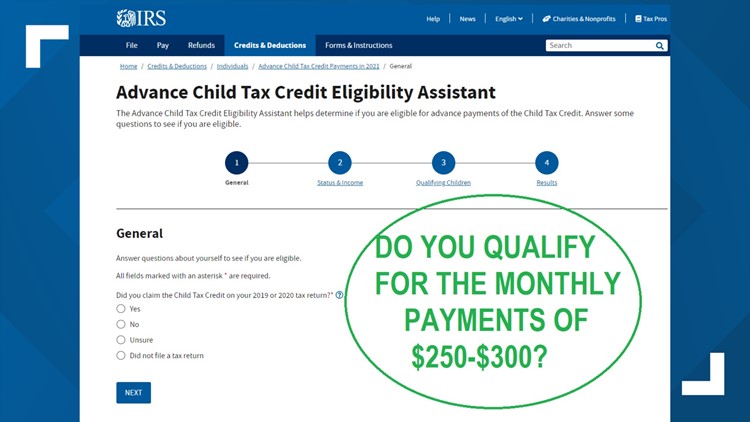

If you have at least one qualifying child and earned less than 24800 as a married couple 18650 as a Head of Household or 12400 as a single filer you can use the Code for. It is a tax law resource that takes you through a series of questions and provides you with responses. The American Rescue Plan increased the amount of the Child Tax.

Court approval letter or our IRS Form 56. Do not call the IRS. The Child Tax Credit program can reduce the Federal tax you owe by 1000 for each qualifying child under the age of 17.

You may be able to claim the credit even if you dont normally file a tax return. The Child Tax Credit CTC provides financial support to families to help raise their children. The IRS says you may be waiting on hold for an average of 13 minutes and that wait times are higher on Monday and Tuesday.

Individual Income Tax Attorney Occupational Tax Unified Gift and. Call this IRS phone number to ask about child tax credit payments tax refunds and. For all other tax law inquiries visit the Interactive Tax Assistant on irsgov.

Resources and Guidance Understanding Your Letter 6416 or Letter 6416-A Understanding Your Letter 6417. Below are frequently asked questions about the Advance Child Tax Credit Payments in 2021 separated by topic. Here is some important information to understand about this years Child Tax Credit.

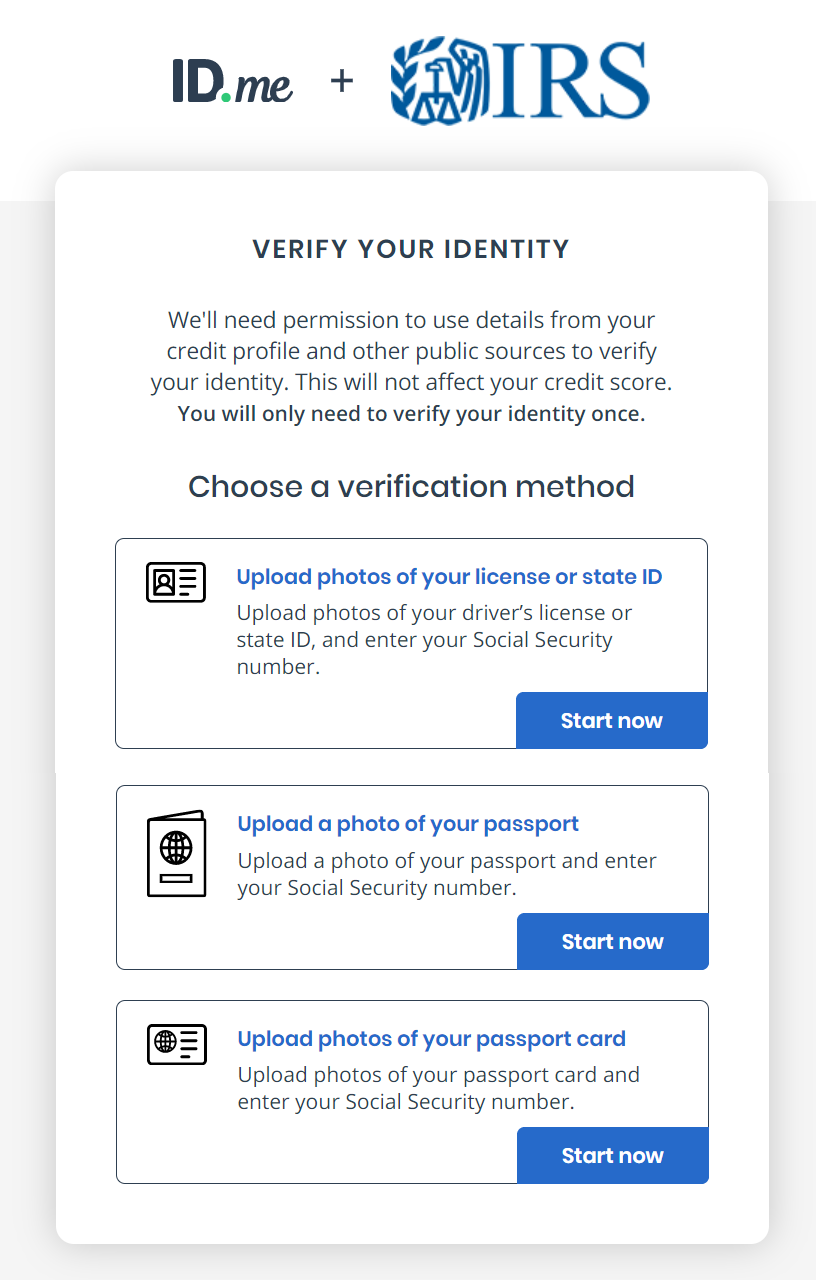

First families should use the Child Tax Credit Update Portal to confirm their eligibility for payments. To get started you can call 800-829-1040 to. The Child Tax Credit provides money to support American families.

Our phone assistors dont have. The amount you can get depends on how many children youve got and whether youre. Third parties calling for a deceased taxpayer.

When you claim this credit when filing a tax return you can lower the taxes you owe. 2021 Child Tax Credit and Advance Child Tax Credit Payments. If eligible the tool will also indicate whether they are enrolled to receive.

The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child age 6-17. Important changes to the Child Tax Credit will help many families. Change language content.

Before calling just a warning the IRS has already advised citizens it is dealing with extraordinary backlogs overwhelming phone calls. Department of Revenue Services. Already claiming Child Tax Credit.

The Child Tax Credit helps families with qualifying children get a tax break. IMPORTANT INFORMATION - the following tax types are now available in myconneCT. If you received any monthly Advance Child Tax Credit payments in 2021 you need to file.

The number to try is 1-800-829-1040.

Internal Revenue Service Launches Web Portal For Child Tax Credit Giving Non Filers Four Weeks To Declare Eligibility

Child Tax Credit Update Portal Internal Revenue Service

Accounting Aid Society Using The New Child Tax Credit Update Portal Families Can Now Unenroll From Advance Payments Meaning They Won T Get The Monthly Payments Set To Start July 15 And

How To Call The Irs With Tax Return And Child Tax Credit Questions Cnet

I Got My Refund Ctc Portal Updated With Payments Facebook

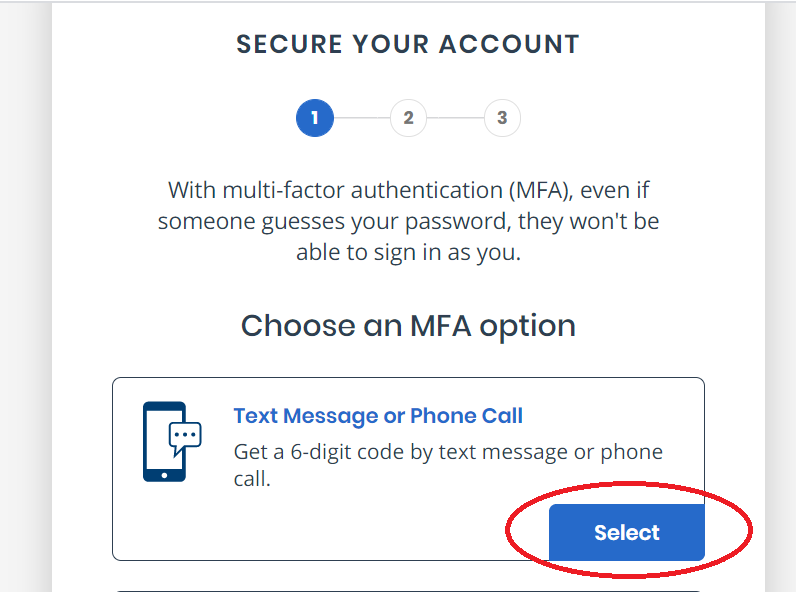

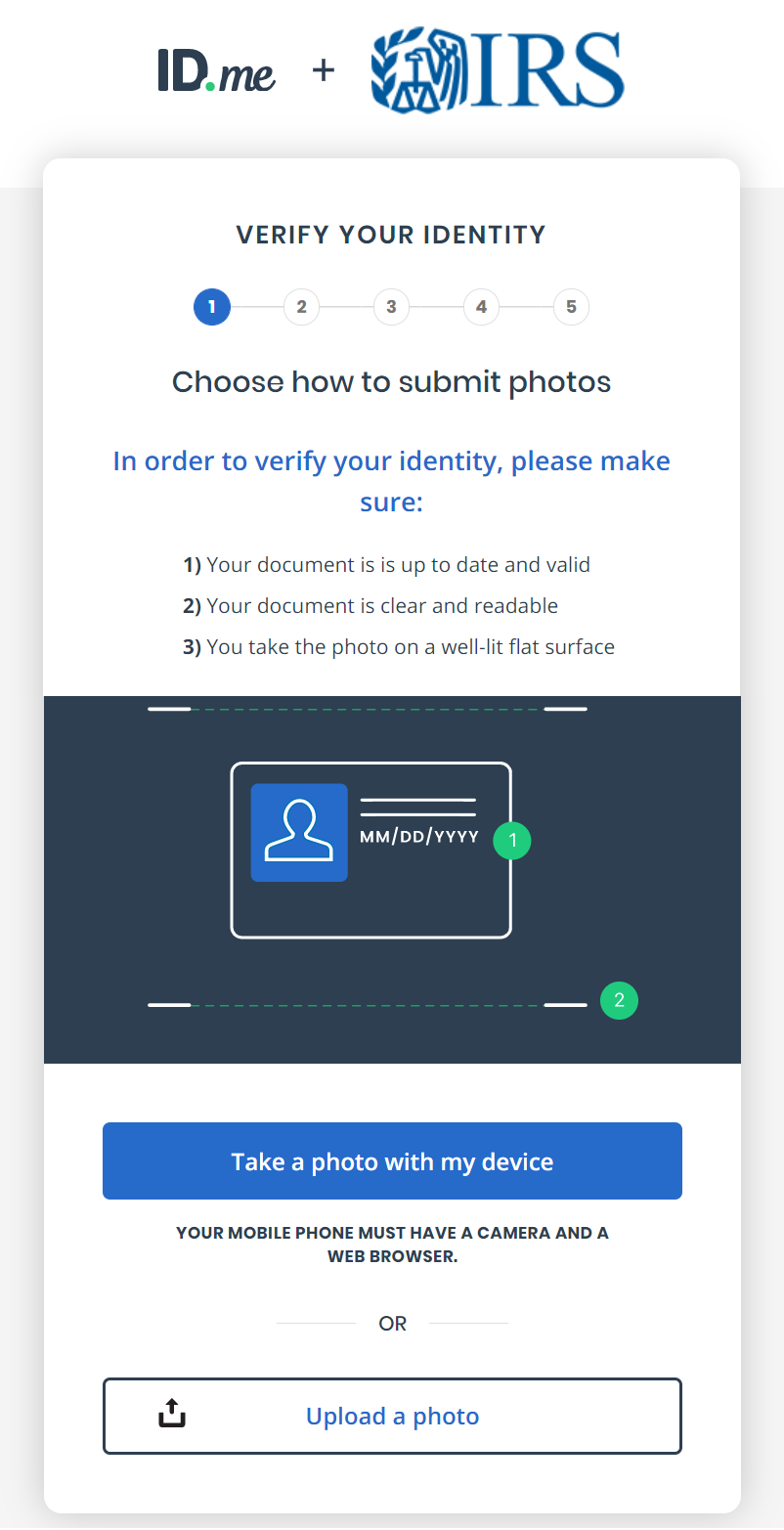

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

H R Block Update Your Income In The Child Tax Credit Update Portal By Nov 29 To Ensure You Re Getting The Correct Amount Of Advance Ctc Payments During 2021 You Can Access

Child Tax Credit Payments Unenrollment Process Lupe Ruiz

Irs Opens Child Tax Credit Portal How To Check If You Re Getting 300 Monthly Payments Syracuse Com

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Opt Out Or Unenroll From The Child Tax Credit Payments Wfmynews2 Com

Do You Qualify For The Child Tax Credit Payments Find Out Here Wfmynews2 Com

How To Change Your Address For Monthly Child Tax Credit Payments Kiplinger

The Irs S Child Tax Credit Non Filer Portal Sucks For Low Income Americans

Child Tax Credit Portal How To Update Your Income Details Before November 29 Marca

How To Access The Irs Child Tax Credit Update Portal Kindred Cpa

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Dependent Children 2021 Tax Credit Jnba Financial Advisors

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back