dependent care fsa vs tax credit

The 35 maximum credit applied to taxpayers with an adjusted gross. If you have two or more eligible dependents receiving eligible care you may set aside up to 5000 in a Dependent Care FSA and claim 1000 of the child and dependent care tax credit.

Coh Dependent Care Reimbursement Plan

The child and dependent care tax credit increased under the American Rescue Plan for the 2021 tax year of up to 4000 in qualifying dependent care expenses for one eligible child or up to 8000 for two or more eligible children.

. Dependent Care Tax Credit. This tax credit is claimed on the federal income tax return. Youre spending twice that so no problem there.

The credit starts at 50 of qualifying child care costs for households earning up to 125000 and goes down to 0 for anyone earning 438000 or more. Prior to the American Rescue Plan Act of 2021 the Dependent Care Tax Credit provided a maximum of 35 of eligible childcare expenses paid during the year as a tax credit. If you use the child and dependent care credit you can claim a tax credit for 25 based on.

Taxpayer receives a 20-35 tax credit for up to 3000 in expenses for one qualifying person and 6000 in expenses for two or more qualifying persons. The Dependent Care Tax Credit allowed taxpayers to claim up to 3000 of expenses for one dependent and up to 6000 in expenses for two or more dependents. For 2021 only unless extended by Congress the dependent care tax credit is fully refundable and the maximum credit percentage increases to 50 from 35.

See the table below. An individual who is under 13 years old and for whom you can claim an exemption. The maximum credit was 35 of eligible expenses resulting in a credit of 1050 and 2100 against total tax liability.

The credit percentage gradually phases down to 20 for individuals with adjusted gross income AGI between 125000 currently 15000 and 183000 and completely phases out for. With the dependent care FSA you can put away up to 5000 for daycare expenses. If you pay more than 6000 in childcare costs dont use the dependent care FSA take the credit.

This will save you 5000 x 12 600 in federal income taxes plus 5000 x 765 FICA taxes 38250 so 98250 in taxes. In 2022 the Child Care and Dependent Care Tax Credit will. Rate decrease of 1 for every 2k.

If you pay 6000 - 11000 in childcare costs you could put the difference between what you expect to pay in childcare costs and 6000 in a dependent care FSA. If divorced or separated see special regulations in IRS. For the 2021 tax year households can claim up to 8000 in child care expenses for one child and 16000 for two or more children.

The credit rate you can claim based on your income has increased. So if you expect to pay 10000 in childcare costs you would put 4000 in. Percentage 125000.

The expense limits are now 8000 for one dependent and 16000 for two dependents or more. What is the Dependent Care Tax Credit.

Flex Spending Accounts Hshs Benefits

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

/dependent-care-fsa-guide-2000-795d22577ea44cb5aecf2e9faccd410a.jpg)

What To Know About Dependent Care Fsas And Saving Money On Childcare

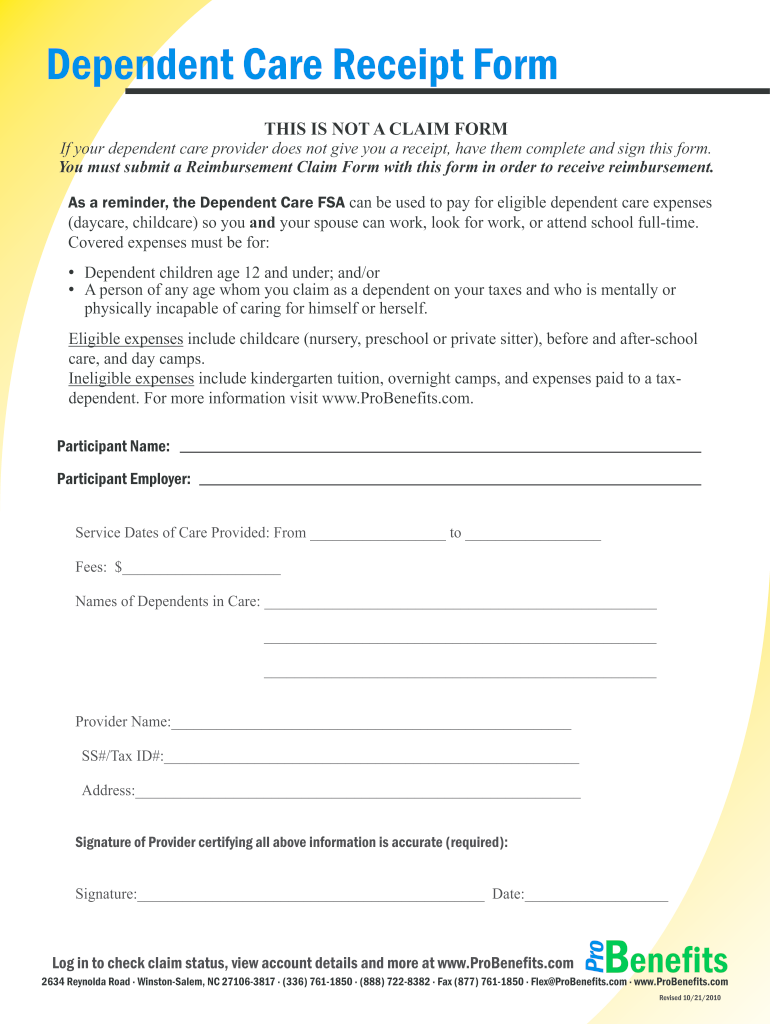

Dependent Care Fsa Babysitter Receipt Fill Online Printable Fillable Blank Pdffiller

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

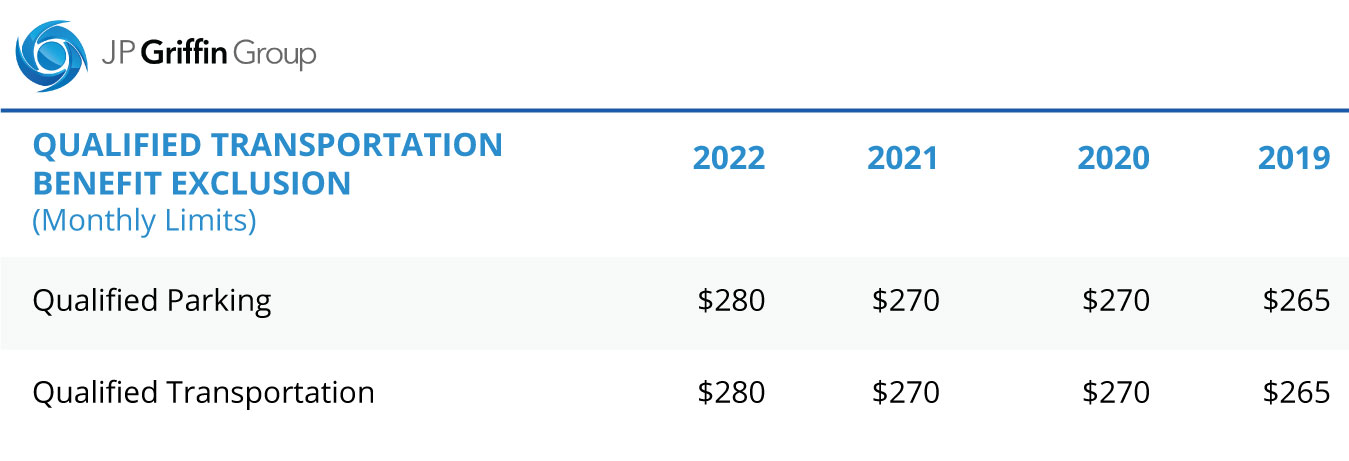

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Dependent Care Flexible Spending Accounts Flex Made Easy

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Open Enrollment Flyers 24hourflex

What Is A Dependent Care Fsa Wex Inc

What Is A Dependent Care Fsa Wex Inc

What Is A Dependent Care Fsa How Does It Work Ask Gusto

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning